Once valued at $22 billion, Byju’s is now seeking funding at a valuation below $2 billion, representing a significant decline, according to a source familiar with the matter.

Pursuit of New Funding

The Bengaluru-based startup, previously India’s most valuable, aims to raise $100 million to $200 million through a rights issue. Byju Raveendran, the CEO and co-founder, is expected to participate in this funding round. Byju’s plans to dilute approximately 10% in the rights issue, potentially lowering the valuation to as low as $1 billion.

Reversal of Fortune

This willingness to reduce its valuation marks a remarkable turnaround for Byju’s, once a standout success story in the Indian startup ecosystem. The company, known for its aggressive acquisition strategy, faced setbacks after its proposed $1 billion funding round last year fell through following the departure of the auditor Deloitte and key board members.

Market Challenges

BlackRock’s decision to devalue its holding in Byju’s further added to the company’s challenges, lowering its implied valuation to around $1 billion. Byju’s IPO plans were also disrupted by market conditions, exacerbated by global events like Russia’s invasion of Ukraine. As a result, the company faced increased pressure from investors to address unresolved issues.

Financial Struggles

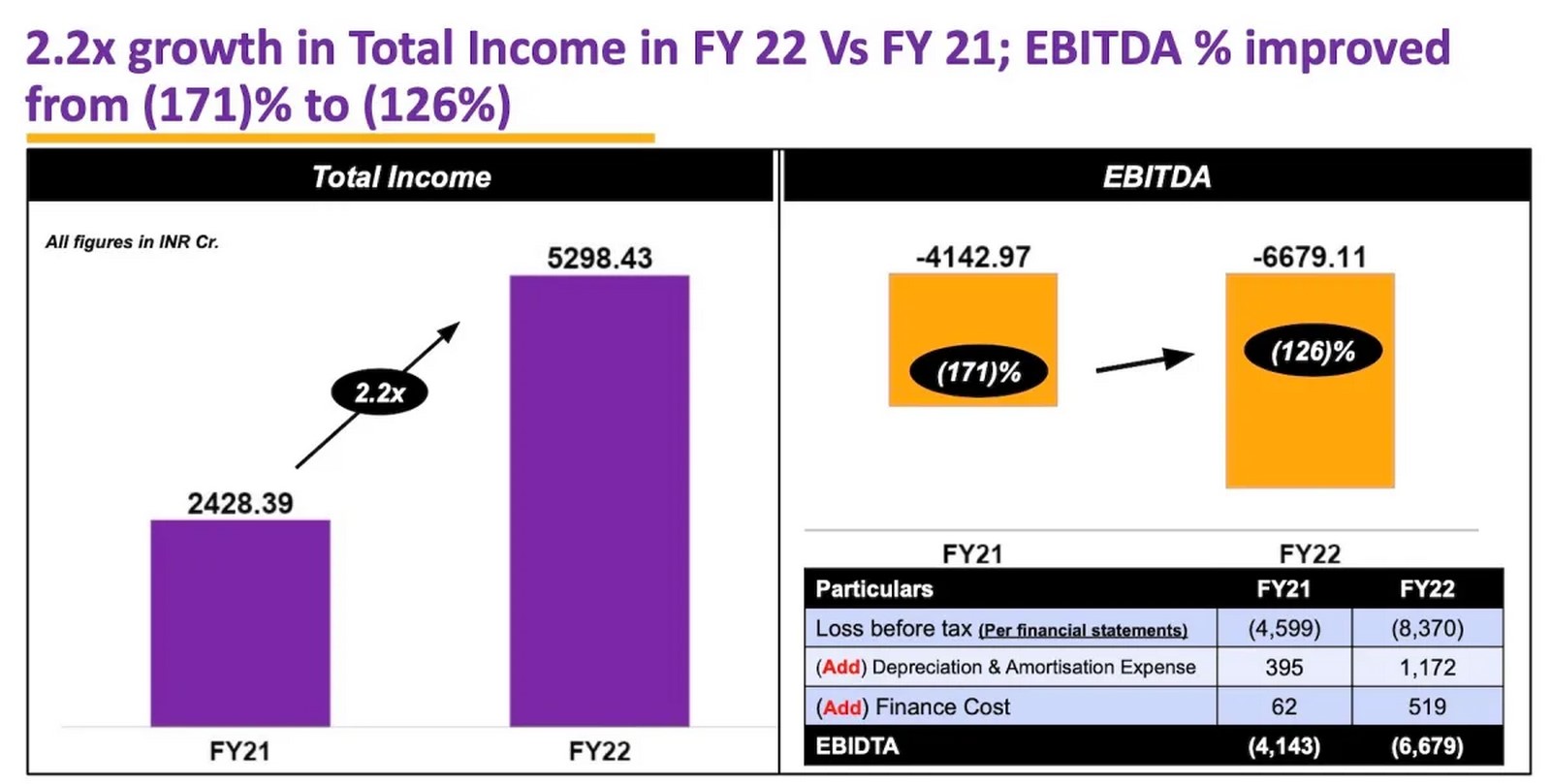

Despite backing from prominent investors such as Peak XV Partners, Lightspeed, UBS, and the Chan Zuckerberg Initiative, Byju’s is currently grappling with various challenges. It has encountered difficulties in raising capital, meeting financial obligations, and addressing its billion-dollar debt. The company also fell short of its revenue target for the financial year ending in March 2022, as revealed in a delayed financial report.

Conclusion

Byju’s, once a high-flying edtech unicorn, is now navigating a turbulent period characterized by valuation declines, funding challenges, and investor scrutiny. As it seeks new funding at a significantly reduced valuation, the company faces an uphill battle to regain its former glory and address the issues plaguing its business operations.

Leave a Reply