Understanding the intricacies of China’s economy can be akin to deciphering a complex puzzle. Recent assessments suggest a divergence between official statistics and the underlying economic reality, posing significant challenges for policymakers. Let’s delve into the insights provided by researchers regarding Beijing’s response to its economic woes.

Discrepancies in Economic Indicators

Despite significant turbulence in the stock markets, China’s GDP growth remains a point of contention. While official figures tout a commendable 5.2% growth in 2023, researchers from the Rhodium Group highlight discrepancies between these statistics and observable trends in consumer demand and foreign direct investment.

Failure to Address Structural Issues

Critics argue that Beijing’s response to economic challenges has been insufficient, focusing more on superficial measures like attracting foreign investment rather than tackling underlying structural issues. According to Rhodium Group researchers, the failure to acknowledge and address these fundamental problems exacerbates the economic predicament.

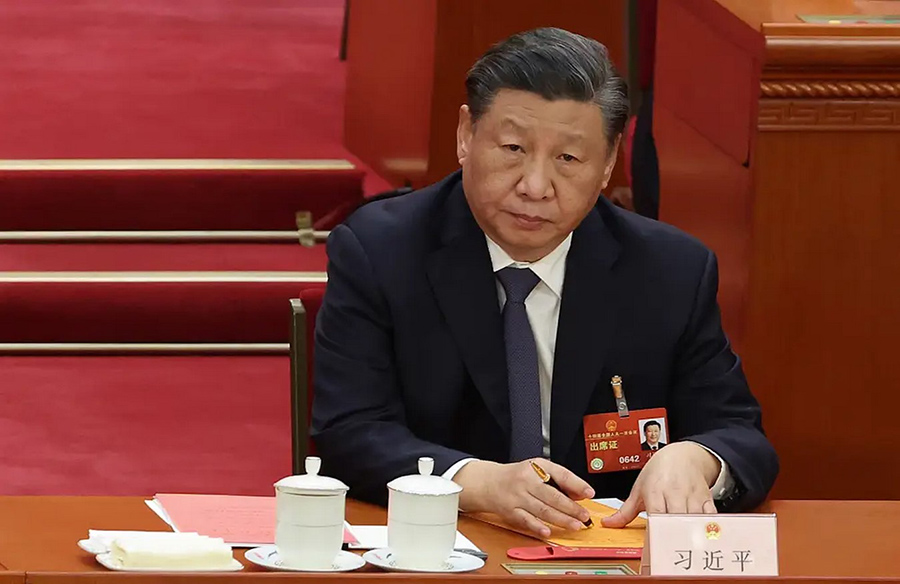

A Rosy Narrative Amidst Uncertainty

Chinese leadership maintains an optimistic outlook on the economy, with President Xi Jinping asserting its resilience and dynamism. However, skeptics question this narrative, characterizing it as a “politicized picture of economic activity” that downplays the severity of the situation.

Challenges and Uncertainties Ahead

Despite official assertions of surpassing growth targets, concerns persist regarding the sustainability of China’s economic recovery. The Rhodium Group warns of ongoing challenges and the potential for market instability, underscoring the imperative for comprehensive reforms to ensure long-term stability.

The Imperative of Market Reforms

In the face of mounting economic pressures, experts emphasize the urgency of market reforms to address underlying structural issues and restore investor confidence. While short-term recovery measures may provide temporary relief, sustained stability hinges on decisive action to enact meaningful reforms.

As China grapples with economic headwinds and strives for sustainable growth, the path forward remains fraught with challenges and uncertainties. Acknowledging the need for substantive reforms is essential to navigate the complexities of the evolving economic landscape.

Leave a Reply