Bulk Exchange, a burgeoning startup dedicated to creating a marketplace facilitating the bulk purchase and disposal of materials for construction companies and contractors, has successfully raised $4.5 million in seed funding.

Rather than pursuing traditional venture capital routes, Bulk Exchange opted to gather the majority of its funding from individuals within the construction industry, as revealed by CEO and co-founder, Paul Foley. Rachel Mahoney, the company’s chief strategy officer, highlighted that convertible notes were utilized to secure the capital.

The decision to seek funding from within the construction sector underscores Bulk Exchange’s commitment to leveraging the expertise and resources of the industry it serves. This strategic approach aligns with the company’s mission to address the pressing needs of construction professionals.

In a recent interview, Foley underscored the necessity of Bulk Exchange’s product, emphasizing the outdated methods prevalent in the industry. He illustrated this by pointing out how construction professionals often resort to cumbersome processes, such as using cork boards plastered with sheets, to source essential materials like gravel and sand.

Despite the perception that tech innovations are primarily associated with industries beyond construction, Bulk Exchange emerges as a pioneer in this niche sector. By streamlining complex and recurrent business processes traditionally reliant on manual methods, Bulk Exchange aims to carve a niche for itself in the construction landscape.

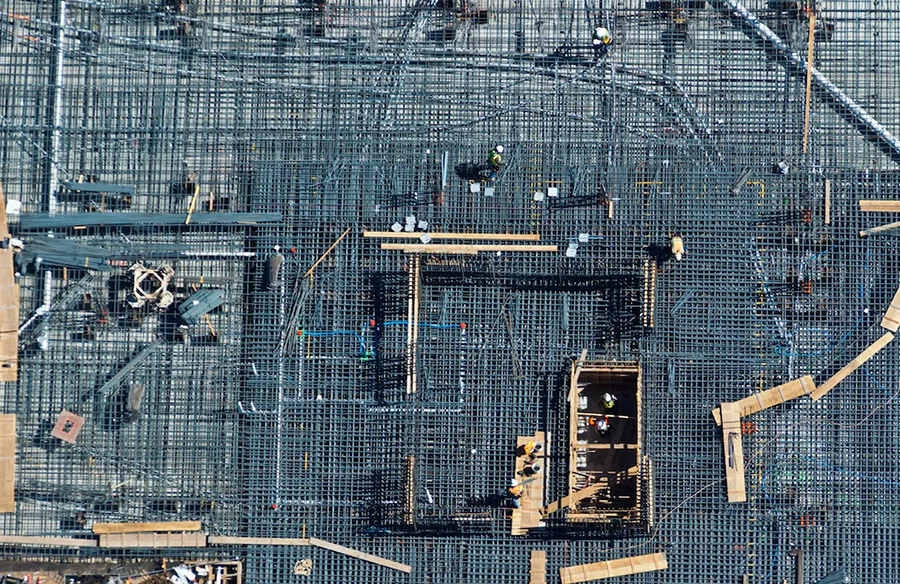

The construction materials market represents a substantial opportunity, with quarries, dumpsites, and related goods constituting a multi-billion-dollar industry. Bulk Exchange seeks to capitalize on this potential by establishing a digital marketplace connecting suppliers, dumpsites, contractors, and estimators for efficient material sourcing and procurement.

The platform addresses two key challenges in construction projects. Firstly, it enables estimators to swiftly determine project costs by providing access to accurate pricing data for input materials. Secondly, it facilitates seamless transactions between buyers and sellers, converting estimates into sales.

In contrast to conventional transactional models, Bulk Exchange refrains from charging transaction fees, recognizing the industry’s narrow profit margins. Instead, it plans to adopt a Software as a Service (SaaS) model for revenue generation.

Looking ahead, Bulk Exchange contemplates additional revenue streams, such as aggregating and selling data generated by its platform. The potential for monetizing valuable insights derived from platform-generated data presents a compelling opportunity for future growth and expansion.

With its services already operational and bolstered by recent funding, Bulk Exchange is poised to reshape the landscape of construction material procurement. As it continues to evolve, the industry eagerly anticipates the impact Bulk Exchange will have on streamlining construction workflows and driving efficiency in material sourcing processes.

Leave a Reply